Written by Dale Lehman, Ph.D., Director of MBA Programs and Professor of Economics at APU

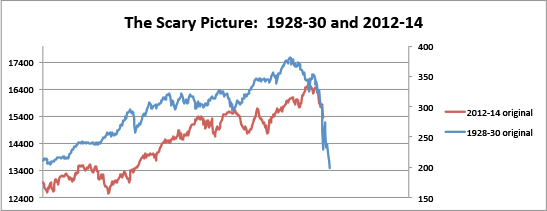

You may have seen buzz like the Wall Street Journal Article, “Scary 1929 market chart gains traction”. There is a generally “Scary Picture” showing an apparent parallel track the stock market is following now to what happened in the crash of 1929. I downloaded the data for the Dow Jones Industrial Average (DJIA) and reproduced the picture as shown here:

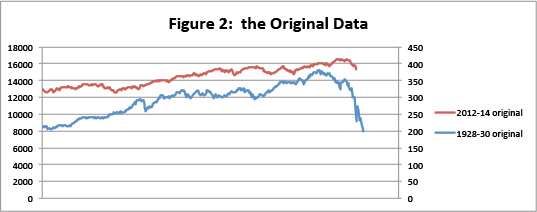

I immediately noticed something strange about the picture – it had two scales, one for 1928-30 and one for 2012-14. This was required because the DJIA was one hundred times lower 85 years ago than today. Fine, but when I downloaded the original data, and used two scales, I got this picture:

This picture is not as scary (though scary enough). In order to get the publicized Scary Picture, not only are dual scales needed, but the vertical scales need NOT to start at zero, but at fixed numbers (12400 for the recent data; 150 for the 1928-30 data).

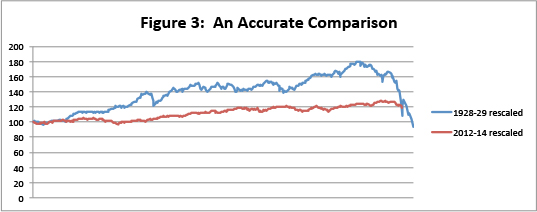

I was not the only person to notice the importance of the dual scales (you can read the comments on the original Market Watch post). Since the recent DJIA involves much higher numbers, the seemingly parallel movement is a much smaller percentage change in the past 2 years than it was 85 years ago. This becomes evident if you graph the percentage changes or put them on a common scale (starting at 100), as I do in Figure 3:

This picture is far less scary and the parallel is not so evident.

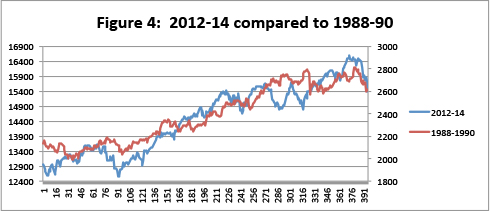

But wait—as the MarketWatch post points out, there can still be a strong correlation, and indeed there is. The correlation in the daily movement of the DJIA in 1928-30 and 2012-14 is 0.84 which is a high correlation. The only problem is that I can find an even higher correlation if I compare 2012-14 with the 1988-90 time period, as in Figure 4:

I selected the 1988-90 period because it was a similar rising period for the DJIA but was NOT followed by the market crashing. Don’t trust the picture, however, since there are two scales. The correlation in the daily DJIA between 1988-90 and 2012-14 was 0.92, higher than in The Scary Picture!

What can we learn from these comparisons? Not much, except that we should not readily trust even (perhaps especially) the experts. I can’t say that they sought to intentionally mislead you – although a fair amount of manipulation was required to produce The Scary Picture, and the experts hardly are objective observers. The correlation to the market crash in 1929 is, in fact, high, but not as high as my hand selected 1988-90 time period when the market did not crash. Perhaps the experts were being careless or perhaps they were seeking to scare investors. And, the market may yet crash. But my point is that the Scary Picture is worthless. This is why I don’t trust other peoples’ analysis of quantitative data. It is not that hard to download the data yourself an produce your own graphics and your own correlations. The fact that The Scary Picture has been circulating on Wall Street for months is genuinely scare to me. It is time that you educate yourself on basic quantitative skills and visual display of quantitative data. It is your money, after all.